March 29th, 2023 - Market Update

Current position: Carefully Floating

Stocks and Mortgage Bonds are both higher to start the day.

March 13th, 2023 - Market Update

Current position: Carefully Floating

Stocks and Mortgage Bonds are both higher to start the day after the Fed and FDIC stepped in to guarantee customer deposits at Silicon Valley Bank and Signature Bank.

March 1st, 2023 - Market Update

Current position: Carefully Floating

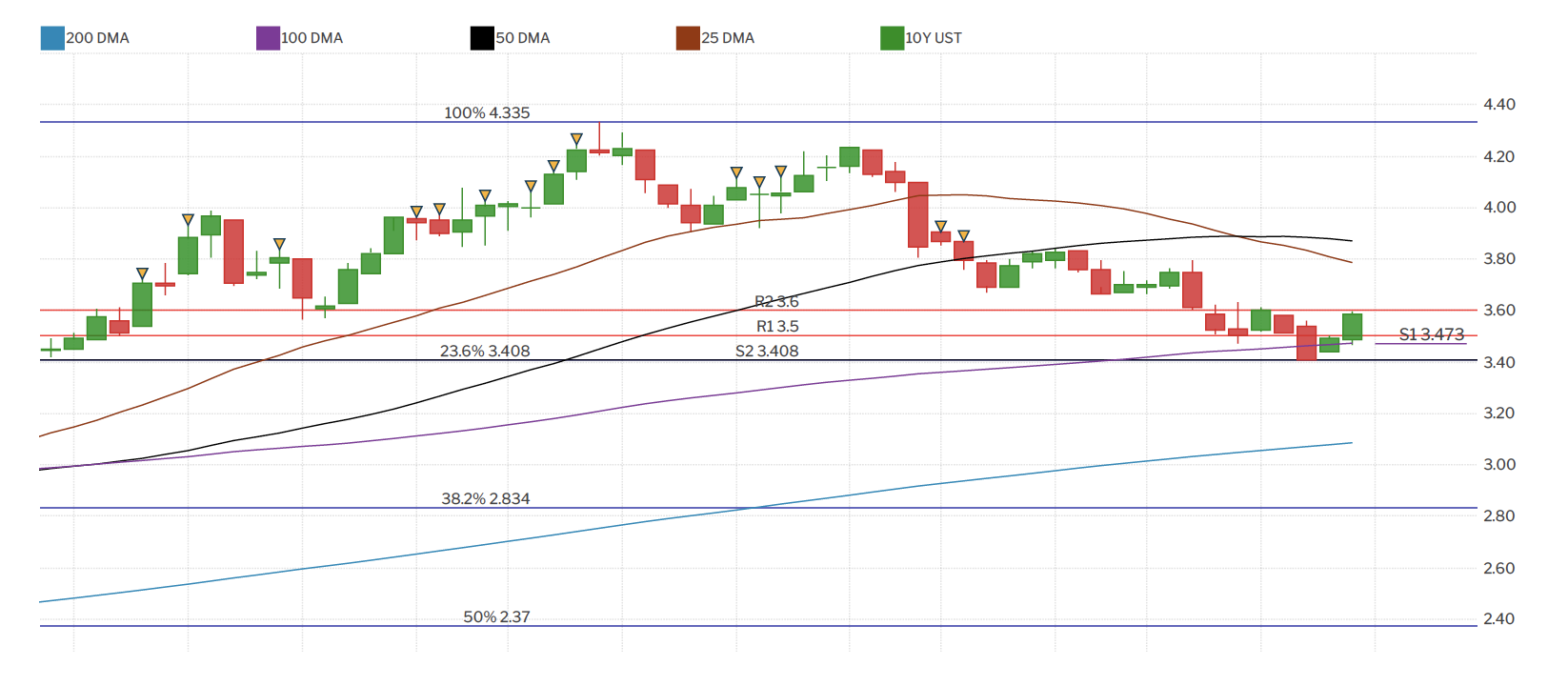

Stocks and Mortgage Bonds are both lower to start the day, with Mortgage Bonds continuing to test and remain above the base of support formed the last seven trading sessions.

February 7th, 2023 - Market Update

Current position: Carefully floating

Stocks and Mortgage Bonds are both trading near unchanged levels after the Fed's favorite measure of inflation, PCE (Personal Consumption Expenditures), was reported, showing that inflation continues to improve.

January 27th, 2023 - Market Update

Current position: Carefully floating

Stocks and Mortgage Bonds are both trading near unchanged levels after the Fed's favorite measure of inflation, PCE (Personal Consumption Expenditures), was reported, showing that inflation continues to improve.

December 22nd, 2022 - Market Update

Current position: Carefully Floating

Stocks and Mortgage Bonds are both lower to start the day. Come next month, there will be a rotation of the regional voting Fed presidents.

December 16th, 2022 - Market Update

Current position: Carefully Floating

Next week is full of important hosing data and the Fed's favorite measure of inflation, PC. We anticipate the PCE report to come in cooler, just as the CPI (Consumer Price Index) report did this past week.

December 9th, 2022 - Market Update

Current position: Carefully Floating

Bonds will go through their monthly coupon rollover after the close of the market today.

December 7th, 2022 - Market Update

Stocks are trading near unchanged levels and Mortgage Bonds are higher after the productivity and unit labor costs report showed cooling inflationary pressures.

November 28th, 2022 - Market Update

Current position: Carefully Floating

Stocks are lower and Mortgage Bonds are higher to start an action-packed week.

November 11th, 2022 - Market Update

Current position: Locking

Stocks and Mortgage Bonds are both lower to start the week.

October 31st, 2022 - Market Update

Current position: Locking

Stocks and Mortgage Bonds are both lower to start the week.

October 25th, 2022 - Market Update

Current position: Floating. Stocks and Bonds are both higher to start the day after a volatile last week.

October 17th, 2022 - Market Update

Current position: Floating. Stocks and Bonds are both higher to start the day after a volatile last week.

October 3rd, 2022 - Market Update

Current position: Floating. Stocks and Mortgage Bonds are both flying higher to start the week now that September is behind us.

September 28th, 2022 - Market Update

Current position: Carefully Floating. Stocks and Mortgage Bonds are both higher to start the day. Mortgage Bonds appear to have found a bottom after a capitulation like move lower on Monday and have had a two-day rally so far, which is something we have not seen in quite some time.

September 26th, 2022 - Market Update

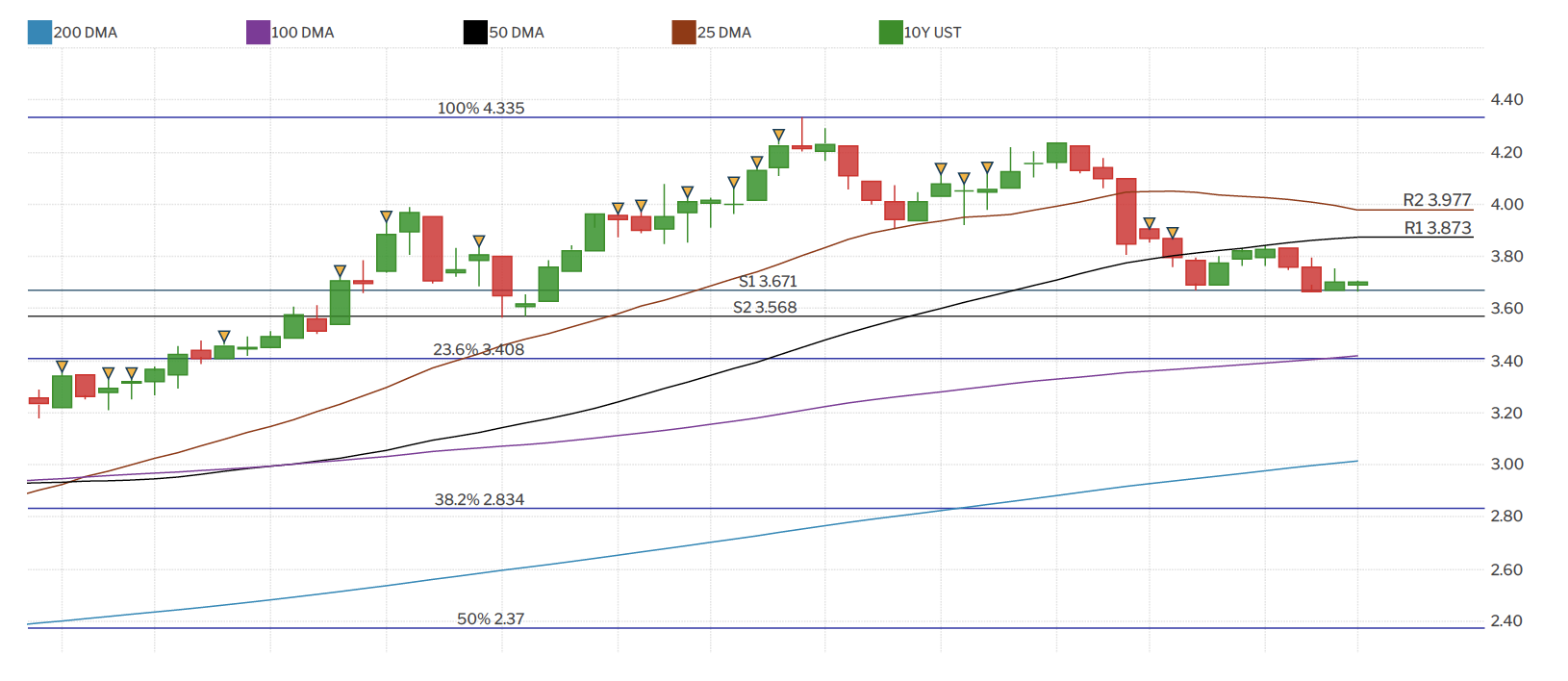

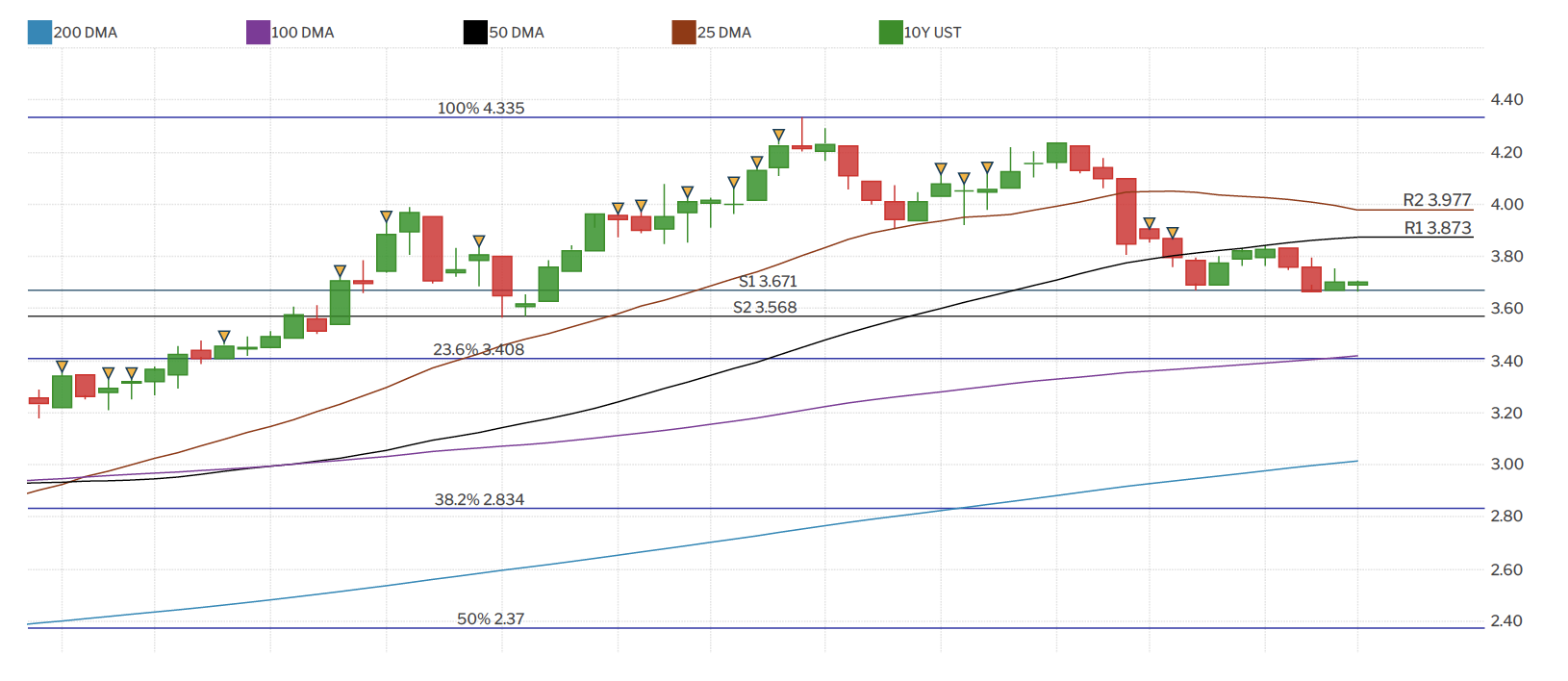

Stocks and Mortgage Bonds are both lower and the 10-year is once again testing 3.75%. The big question is, how long will this last and when will we start to see both inflation and mortgage rates come down?

September 22nd, 2022 - Market Update

Current position: Locking. Stocks and Mortgage Bonds are both moving lower this morning, following the Fed's highly anticipated Statement and Press conference yesterday. The Fed hiked the Federal Funds Rate by 75bp, as expected, and continued to beat the drum that inflation is still far too elevated.