December 9th, 2022 - Market Update

Current position: Carefully floating

Bonds will go through their monthly coupon rollover after the close of the market today. This occurs each month because Mortgage Bonds are finite. They have an end term, such as 30 years. Therefore, each month a new 30-year period begins. This new 30-day extension is reflected in an adjusted rollover price. This rollover does not impact your rate pricing.

Stocks and Mortgage Bonds are both lower after producer inflation was hotter on a month over month basis, but there were still significant improvements in the year over year readings.

Producer Price Index

The November Producer Price Index (PPl) report showed that overall producer inflation increased by 0.3%, which was one tenth hotter than expectations.

Year over year, inflation declined from an upwardly revised 8.1% to 7.4%. While this was a little higher than the 7.3% expected, it is still a meaningful decline of 0.7% year over year.

The Core rate, which strips out food and energy prices, rose 0.4%, which was hotter than the 0.2% anticipated. Once again, however, year over year core inflation decreased from 6.7% to 6.2%. This was also higher than expectations of 5.9%, but is still moving in the right direction and a half a percent improvement from the previous reading.

Next Week

Next Tuesday the November CPI report will be released, where we think we will continue to see headline and core inflation move lower. Additionally, on Wednesday, the Fed meeting will conclude and they will release their statement, followed by a Powell press conference. Even though the Fed is going to hike 50bp, we think they may have to acknowledge the drop in inflation. If their tone is a bit less hawkish, we could see another nice move in the Bond market.

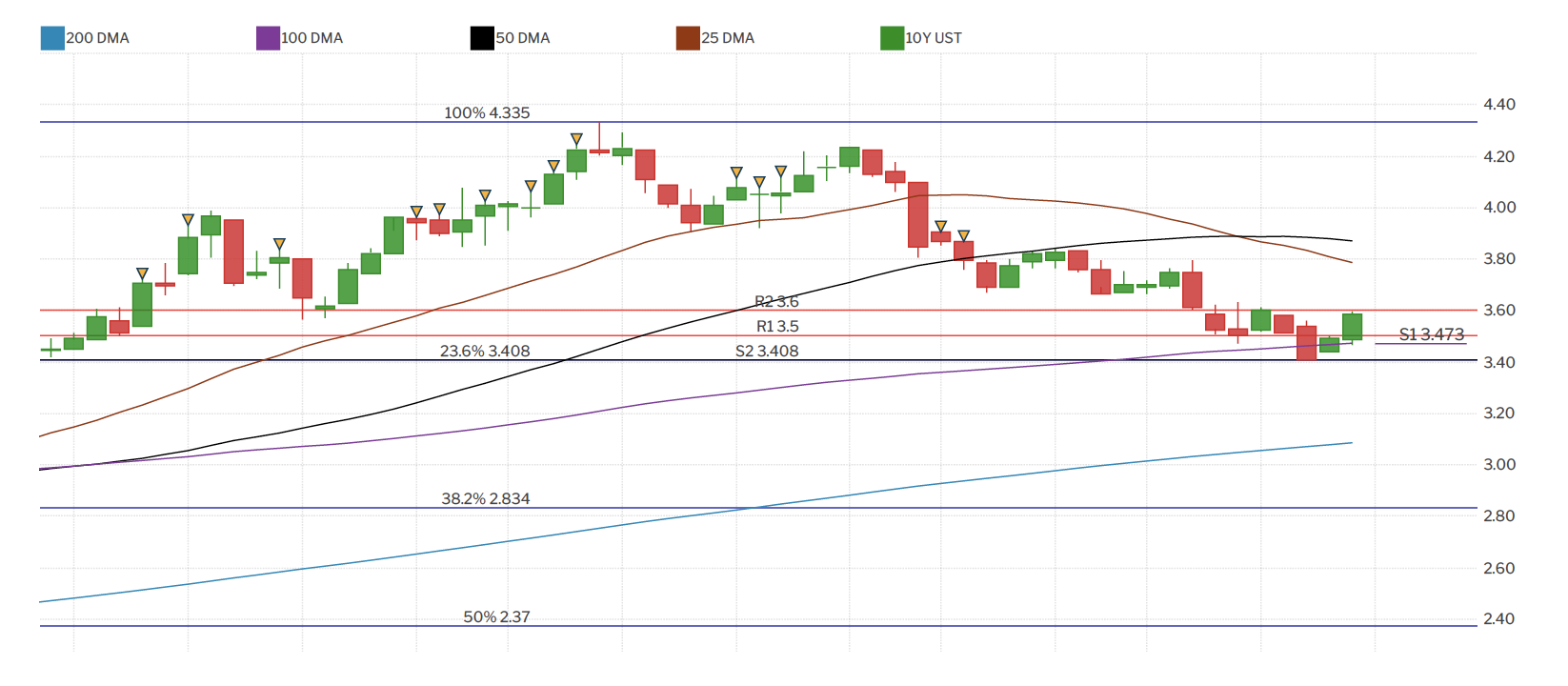

Technical Analysis

Mortgage Bonds have broken beneath their 100-day Moving Average and are lower on the day, which is a negative. But there is support not too far beneath present levels at the 100.53 Fibonacci level, and even though prices have moved down, we are going to ride this out and be patient with some potentially Bond friendly news next week.

Continue Carefully Floating.

Source: MBS Highway

Join our Watchlist

Our Watchlist is a free service we offer to ensure you never miss an opportunity to lower your interest rate. There is no obligation associated with joining.

We’ll track rates and market conditions on your behalf, and reach out when we see an opportunity to save you money.

Questions?

Reach out any time. We’re here to help you find the best mortgage program for your unique conditions.

Contact us:

847-634-2252

info@longgrovemortgage.com

Or start an application.